ETP V5.5 – Omni-channel Retail Solutions

Localization

E-invoicing for Transfer orders in India GST

For the E-invoice Eligibility check below conditions must be satisfied:

- Property “E-Invoicing(B2B)” must be Either Auto or Manual.

- Property “E-InvApplicableDate” must have Value Less then or equal to the BOD date (Transaction date).

- The Selected Customers/ Store /Warehouse (To) GSTIN Number and the transaction Store‘s (From) GSTIN Number must be Different or must not be Blank.

Modules under which E-invoice Transactions can be performed are as mentioned below:

- Billing

- Sales Return

- Bill Cancellation

India GST is the tax, which is circulated by the India Govt. There are 4 different percentiles of tax which are being applied throughout India. These different percentiles are charged or calculated based on items and states. GST or tax applicable on items varies state to state.

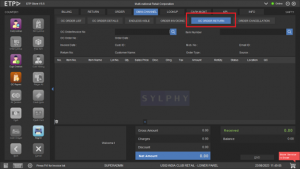

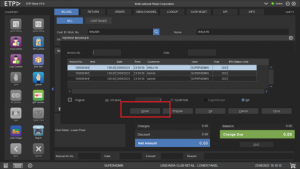

In Store Front, locate Bill Tab and enter below details:

- Collect/Delivery mode- Collect /Deliver(Collect is by default system selected for normal transaction and if Deliver option is selected then only registered customer are allowed for billing)

- Customer ID

- Customer Name

- Item Number

Value Addition: Enabling e-invoicing for transfer orders streamlines the documentation process for inter-store transfers. It ensures compliance with e-invoicing regulations and simplifies the invoicing process for these transactions.

E-invoicing for Vendor Purchase Returns in India GST

Vendor Purchase return can be done Reference of Purchase order- Based on Purchase order Retail customer return can return the qty and GST taxes would be applied on the same GST rate which we have purchase order receiving.

Following are steps to do vendor purchase return with PO:

- Login Store operation

- Go to vendor purchase return

- Click F4 on PO no and fetch Purchase order number

- Click on return qty and tax would be applied as per purchase order like if CGST/SGST applied so while returning also CGST/SGST will be applied as below<

Value Addition: E-invoicing for vendor purchase returns improves accuracy in tax calculation and documentation. It aligns with e-invoicing requirements and facilitates seamless transaction reporting.

Kerala flood cess functionality for India GST

The Kerala Flood Cess is applied only when the Invoicing/Billing is done from a Store which belongs to Kerala State. Hence, the B2C transaction will only be having the Kerala Flood Cess Component over and above CGST and SGST. {All Billing Transactions from StoreFront}

The B2B Business Transactions won’t be having the Kerala Flood Cess Component over and above CGST and SGST (Mainly Stock Management Transaction from StoreOperations)

This flow of the Feature is as follows:

- KFC tax will be defined as Other charge ( Charge type 4) with place as State and HSN wise rate.

- KFC charge will be attached in the existing GST model.

- Storefront will handle additional state level tax (KFC) with place and HSN code.

- The Output format of Invoice will be changed.

- The Following Modules of StoreFront (located in the State of Kerala) will be applicable for KFC

- Billing

- Return (Only the KFC Component will be displayed in Return Note/Document print)

- Order

- Order Cancellation

- Order Invoice

- Endless Aisle

- OC invoice

- OC Cancellation.

Value Addition: This development ensures compliance with regional tax regulations. It automates the application of Kerala Flood Cess based on the state of operation, preventing errors and facilitating accurate invoicing

Korean language support

We have developed the Korean language for the South Korea country “Zuel” product under which SF, SO, and Android applications are available and these applications are in the Korean language.

Value Addition: This development enhances the accessibility of your software for users in South Korea by providing an interface in their native language. It makes the product more user-friendly and reduces language barriers.

Paytm wallet integration

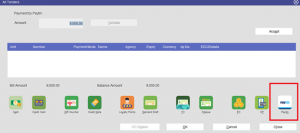

PayTm (E-Wallet):

PayTm can be Activated based on the Property Activate Paytm from SO.

If the Property is set to Y then the Paytm Payment Mode will be Displayed on the All Tender Screen as shown below.

- On Selecting Paytm Payment mode the user needs to accept the Payment by clicking on the Accept button.

- On Click of the Accept Button the QR code will be Displayed on the Paytm Device which the Customer will have to Scan through his device and Complete the Payment.

- After Accept Payment the Validate Button will be enabled for Validate the Transaction.

- After which the Cashier can Validate the Payment by clicking on the Validate Button.

Note:

- If the Device is not Connected then the Transaction cannot be completed.

- If Device is not connected then the Alert message is shown “There is an error during Paytm Request, Please Retry!!. ”.

Value Addition: Integration with Paytm wallet offers customers a convenient and secure payment method. It broadens payment options, increasing customer satisfaction and facilitating seamless transactions.

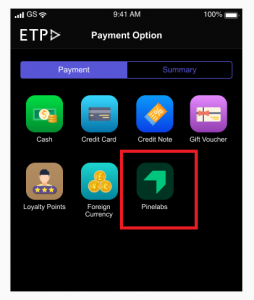

Pinelabs EDC - Cloud based API integration

There is a need to integrate billing application on tablet/smartphone/any other device without using local connectivity interface/interfaces. The local interfaces are serial cable, USB cable, Bluetooth, NFC etc. These interfaces may not commonly be available on all devices hence one will have to bring in the support for all possible interfaces. In order to solve this, one can use cloud-based integration. Cloud based integration defines a transaction mapper on the cloud. This mapper is nothing but a hosted service by Pine Labs. Merchant’s Billing application on any device can consume this web-based API to post the transaction data into the mapper. In return a Unique Plutus transaction reference ID (PTRID, referred hereafter) gets generated and sent back to the merchant’s billing application. This PTRID is used on Plutus terminal to accept payment against the transaction in subject. Once payment has been accepted on the Plutus terminal, charge slip gets generated. Merchant’s billing application can use another web API to fetch the transaction status along with relevant details using

Value Addition: Integrating Pinelabs EDC through cloud-based APIs simplifies payment acceptance by enabling transactions without relying on specific local connectivity interfaces. This enhances flexibility and compatibility for payment processing.

Validation for saving of Customer GSTIN no. in Customer registration

For India GST Localization the Customer GSTIN is also Captured which is not a mandatory field and also the Customer GSTIN number is validated in two different ways.

- The GSTIN Format Entered

- The GSTIN Number Current Status Validation as per ASP Portal.

- The GSTIN Format Entered

The Entered GSTIN Format will be validated on the bases of the below mentioned Format.

- First two digits will be numeric (which refer to is state code)

- Next 10 digits will be the pan card number.

- First 5 digits will be alphabets

- Next 4 digits will be numeric

- Last 1 digit will be the Alphabet.

- The remaining 3 digits are not to be validated.

If the entered GSTIN Number is not matching the above combination (for the 1st 12 characters) then the system should give the alert message “Please enter Correct GSTIN Number”.

Value Addition: Validating and capturing Customer GSTIN in the registration process ensures accurate tax documentation. It prevents errors and ensures that the GSTIN follows the correct format, complying with tax regulations.

New Functionality

Auto acceptance of Omni-channel Orders in Store

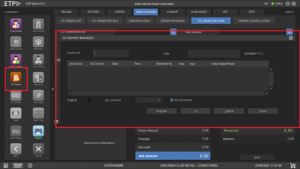

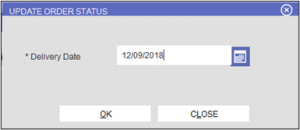

Accept: Click Accept button to receive the order .User can select the Delivery Date. This changes the order status Accepted .In case able to process the order based on availability of stock. The status of order Sends from store to Connect as Accepted.

Auto Accept: Auto Accept OC order can be activated by Changing the Value for the Auto Accept OC Order to Y and also need to configure the Default No of days for Delivery property value. For Eg. If the Default number of days for Delivery value is set for 5 and the System Date is 15-04-2021 then the Delivery date for the OC order after Auto Accept will be set as (15-04-2021 + 5 days) 20-04-2021.

After Auto Accept the Order Status is also sent back to Connect as Accepted

Note: If the Auto Accept of OC Orders is turned on then the Order won’t reflect in the OC order Tray as the order is already accepted.

Value Addition: The auto acceptance feature speeds up the order fulfilment process in the omni-channel environment. It reduces manual intervention, improves order accuracy, and enhances customer satisfaction by ensuring timely deliveries.

Benefits of ETP V5 Grocery Retail

Weighing scale integration: ETP Store seamlessly integrates with weighing scale machines in-store to enable quick checkout of perishable products with accurate pricing and latest promotions.

Weighing scale integration: ETP Store seamlessly integrates with weighing scale machines in-store to enable quick checkout of perishable products with accurate pricing and latest promotions.

Selling in decimal quantities: ETP Store enables to sell in decimal quantities with precision and ease, enhancing the shopping experience.

Multiple retail price handling: ETP solution provides flexibility and control to enable multiple retail prices for FMCG products on shelf. At the same time, it enables quick checkout of customers buying such FMCG products.

Latest price and promotions: ETP solution allows grocery business to stay agile by implementing faster price changes and promotions to stay ahead of the competition.

Redefining cost-efficiency: ETP provides cutting-edge Point of Sale solution compatible with the Windows and Linux platforms — secured and reduced cost of ownership.

Channel-based promotions: ETP solution enables to develop, track, and modify relevant promotions for different retail channels.

Build loyalty: ETP Store offers seamless visibility and control of loyalty programs across all customer touch-points.

Quick checkout of fast moving products: ETP Store is touchscreen enabled and provides seamless user interface with hot keys for selling fast moving products.

Customer initiated returns in Omni-channel

OC Order return has 2 types (CC) Click and Collect and (CD) Click and Deliver, the CD Order can be Returned Online by placing Online Return Request whereas for the CC orders the Product should be returned at Store.

Also QC Reprint Button is newly added for the OC Sales Return left panel.

When Clicked on QC Reprint

Value Addition: This development provides a user-friendly way for customers to initiate returns, enhancing customer experience. It differentiates between return processes for Click and Collect (online) and Click and Deliver (in-store) orders.

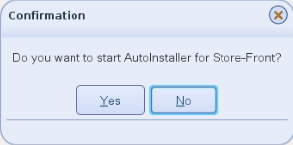

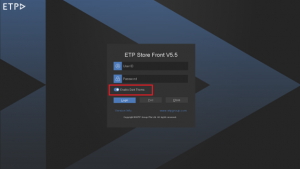

Design change in ETP Updates to enable auto installation feature at stores

The Application will check for the Auto Installer service on Download manager start-up first and if the service is not in running state then a popup message will be displayed stating “Do you want to start Auto Installer for Store-Front?” along with Yes and No Buttons on click of no the Auto Installer utility for that component won’t be started where as when clicked on Yes the Auto Installer for that a particular component will be started. Refer the below displayed image for reference. When you right-click the icon, these options appear - Open, Open my downloads folder, View log, and Exit option.

Value Addition: This design change streamlines the process of auto-installing updates at stores. It simplifies the initiation of the auto installer service, making the installation process more user-friendly and efficient.

ETP Mobile Store: PAX A920 device support in ETP Mobile Store Promo item identification with ribbons, Dark theme, Discount override authorization, Info button in home screen

We have developed a new Android reactive native application for billing and inventory management and this application is compatible with our PAX 920 Devices only.

We have developed a new Android reactive native application for billing and inventory management and this application is compatible with our PAX 920 Devices only.

Value Addition: The new mobile application provides comprehensive support for various functionalities. Support for specific devices, promo item identification, dark theme, and other features enhance the application's usability and versatility.

Handling of Non-merchandise items

For Non-Merchandise Items the Inventory management allowed flag is configured at the Item Master Creation .

- 1. During Non-Merchandise Billing the Inventory will not be maintained.

- 2. Return for the Non-Merchandise Item won’t be Accepted instead Message will be shown as “Non-Inventory Items cannot be returned, Kindly scan inventory items only.“ As shown in the below screenshot during Item Scan of non-inventory Item.

Value Addition: This development ensures proper handling of non-merchandise items, preventing errors in inventory management. It improves accuracy in tracking inventory and returns, avoiding confusion and facilitating smoother processes.

Cash drawer opening integration in Ubuntu

Value Addition: Capturing multiple EDC banks in shift end and Z read reports provides comprehensive reconciliation of credit card transactions. This feature enhances accuracy in financial reporting and end-of-day processes.

25. Cash drawer opening integration in Ubuntu : -

It helps users to use the Cash Drawer, which is attached to the POS machine at the Counters.

Functionality Settings- Store Operations – Settings – Counter.

In the attached printer there is a setting for the Cash Drawer to open the cash drawer after printing or before printing.

Also, any user other than Super Admin should have the access rights for executing this functionality.

Cash drawer will open for billing, sales return , advance order, order invoicing, order cancellation, lift & drop opening balance and shift end.

Value Addition: Integrating cash drawer opening in Ubuntu-based systems improves cash management at counters. It enhances security and efficiency in cash handling during various transactions.

Each of these developments contributes to improving different aspects of your software, ranging from compliance with regulations, accuracy in financial transactions, customer experience, operational efficiency, and more. The combined effect of these improvements enhances the overall functionality and user satisfaction of the software.

Re-send emails from the Reprint function

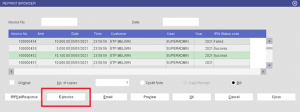

In the Reprint Browser the New Button mentioned below are the details and Use of them:

- Email Button -- To Send the Duplicate Invoices to the Customer on E-MailID

- IRN Fail Response Button -- To check the List of Failed IRN Status Code Invoices

- E-invoice Button -- To Check the Logs for the IRN Generation and also to Retrigger or Update IRN for Manual IRN Status Code, also the user can Export the Invoice for IRN Generation in JSON Format.

Email Button:

- Email Button is Provided for Sending the Emails for the IRN Status Code Blank Or Success Invoices.

- If the Customer Request for the Copy of the Invoice on Mail and if the Customer had not mentioned the invoice on Email during the Invoicing Process then from Reprint the Duplicate Invoice Copy be Mailed to the Customers Email Id.

Value Addition: This feature enhances communication by allowing users to re-send invoices and manage failed IRN (Invoice Reference Number) statuses efficiently. It helps in maintaining accurate records and addressing customer inquiries.

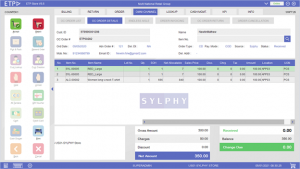

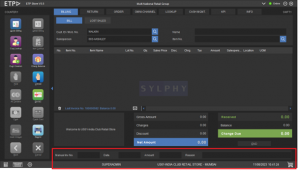

Salesperson in Omni-channel invoicing

Value Addition: Enabling salesperson selection at line and header levels provides better tracking and attribution of sales. This helps in analysing sales performance, rewarding sales staff, and enhancing customer service.

Value Addition: Enabling salesperson selection at line and header levels provides better tracking and attribution of sales. This helps in analysing sales performance, rewarding sales staff, and enhancing customer service.

- Users can search the order for Invoicing OC Order No. and Item No. This displays the order level details such as Item No, Item Name, Lot No., Qty, Sales Price, Disc., Charge, Tax, Amount, Sales Person, Location, UOM

- Sales Person can be Selected at Line Level as well as Header Level

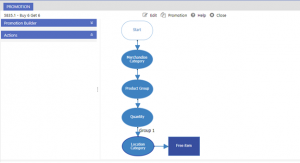

Use Customer attributes in Promotions, Customer hierarchy made non-mandatory

- Customer attributes: Customer category consists of the customer’s details such as the age, gender, spouse birthday and the anniversary date.

- Merchandise Category: Merchandise Category constitutes of Various brands, manufactured items, style items and quantities

Value Addition: Incorporating customer attributes in promotions allows for more personalized marketing efforts. Making the customer hierarchy non-mandatory simplifies the process, promoting flexibility and agility in creating promotions.

Report

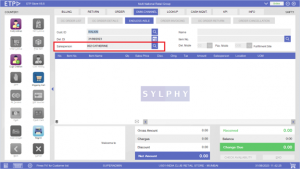

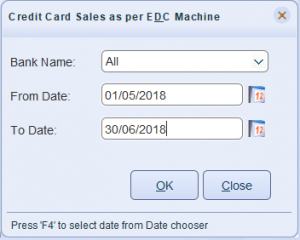

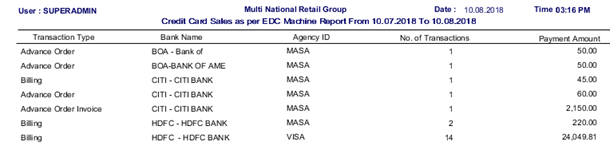

Multiple EDC Banks capturing in Shift end and Z read

Earlier we have developed the EDC Pine Lab integration feature under the Credit card Payment modules for bill settlement and also we have registered multiple bank names under the EDC modules.

Earlier we have developed the EDC Pine Lab integration feature under the Credit card Payment modules for bill settlement and also we have registered multiple bank names under the EDC modules.

We have a Z report and shift end report for EDC modules and it’s getting generated successfully.

Report name are -

- Opening Balance

- Shift End report

- Z - read report

Value Addition: Capturing multiple EDC banks in shift end and Z read reports provides comprehensive reconciliation of credit card transactions. This feature enhances accuracy in financial reporting and end-of-day processes.

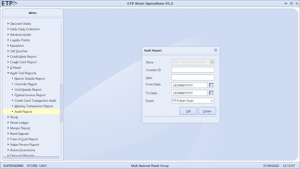

New audit report in ETP Store Operations

Value Addition: The audit trail reports provide transparency and accountability in store operations. Users can track and analyse various transactions, helping to identify issues, prevent fraud, and improve overall store management.

Value Addition: The audit trail reports provide transparency and accountability in store operations. Users can track and analyse various transactions, helping to identify issues, prevent fraud, and improve overall store management.

The Audit Trail Reports provides the details of transactions pertaining to store audit (price override, item override, parking etc.) for counter, and date / date range. It enables you to generate and view details of the following reports:

- Return Details Report

- Price Override Details Report

- Void Details Report

- Parked Invoice Report

- Credit Card Transaction Audit

- Missing Transaction Report

- Audit Reports

Upload tool for Master data in EAS

Upload tools is Used to map the item codes against a channel created for a Web Store or marketplace.

The objectives of macros in Excel are to automate repetitive tasks and streamline workflows. By recording a series of actions or writing VBA code, macros that perform complex operations with just a few clicks of a button. Some specific objectives of macros in Excel include:

- Saving time: Macros can automate tasks that would otherwise be time-consuming to perform manually, such as formatting data or generating reports.

- Reducing errors: Macros can help to reduce errors by performing tasks consistently and accurately, without the risk of human error.

- Enhancing productivity: By automating repetitive tasks, macros can free up time for more important tasks, which can enhance productivity and efficiency.

- Improving data quality: Macros can perform data cleaning and validation tasks, ensuring that data is accurate and consistent across multiple worksheets or workbooks.

- Enabling complex analysis: Macros can be used to perform complex calculations, statistical analysis, and other advanced data analysis tasks that would be difficult or time-consuming to perform manually.

- Overall, the objectives of macros in Excel are to make it easier and faster to work with data, improve data quality, and enable more advanced data analysis.

Value Addition: The upload tool simplifies the mapping of item codes for different channels, reducing manual effort. It ensures accurate and consistent data mapping, which is crucial for maintaining a well-organized online presence.

Specification of field details for Tools-Upload

| Tools-Upload | ||

|---|---|---|

| Field | Description | Field Type |

| Function | Use to select function from dropdown | Mandatory Field. Select from the drop down list. |

| File type | Use to select file type to upload | Mandatory Field. Select from the drop down list. |

| File Path | Path from where file need to be uploaded | Mandatory Field. |

| Browse | Use to browse the file path to upload | Mandatory Field. |

| Action Required | Use to Add or update the file. User can select based on the requirement. | Mandatory Field. |

User Interface

Dual display screen support for 1024 X 768 resolution

This development was unified in order to enhance the billing experience of a customer. This feature allows the customer to view the billing of his purchase.

Value Addition: Dual display screen support enhances customer experience during billing by providing a clear and easy-to-read display of their purchase details. This feature improves customer satisfaction and transaction transparency.

Trendy Dark theme for ETP Store

- Its enable using toggle function or Counter wise dark theme property is set to Y

- If the Property value of the Dark theme value is N, Then Normal Theme applied on the storefront application

- If the Property value of the Dark theme value is Y, Then Dark Theme applied on the Storefront Application.

Value Addition: Offering a dark theme option enhances user experience by providing a modern and visually appealing interface. It caters to user preferences and potentially reduces eye strain during prolonged usage.

Ordazzle – Ecommerce Management Solutions

New Integrations

Channels

- Flipkart

- Shopee V2

- Zalora V2

- Tiktok

- Amazon

Carriers

- Entrego

- Grab (WIP - expected completion in the next couple months as it is for SSI)

- Lalamove (WIP - expected completion in the next couple months as it is for SSI)

- Worklink Dalivery (WIP - expected completion in the next couple months as it is for SSI)

Ordazzle - ETP Store

New Devices

Mobile App V1

iPad compatibility

New Features

Order Management

- Capturing Package Dimensions

- Bulk Packing

- Ability to get Shipping Label without RTS

- Directly Print Labels/Invoices/Manifests

- Lazada ‘Automatic Shipped Update’ for Lazada Fulfilled

- Mass Search - Ability to search for orders in bulk to process multiple orders together

- Ability to print multiple Shipping Labels in one go