“One nation, one market, one tax”- was the notion on which GST was formed. GST which came into effect on July 1st, 2017 was the biggest tax reform in Indian history

3 years on, we have to ask ourselves, has GST had a positive impact on the Indian Economy?

What is GST?

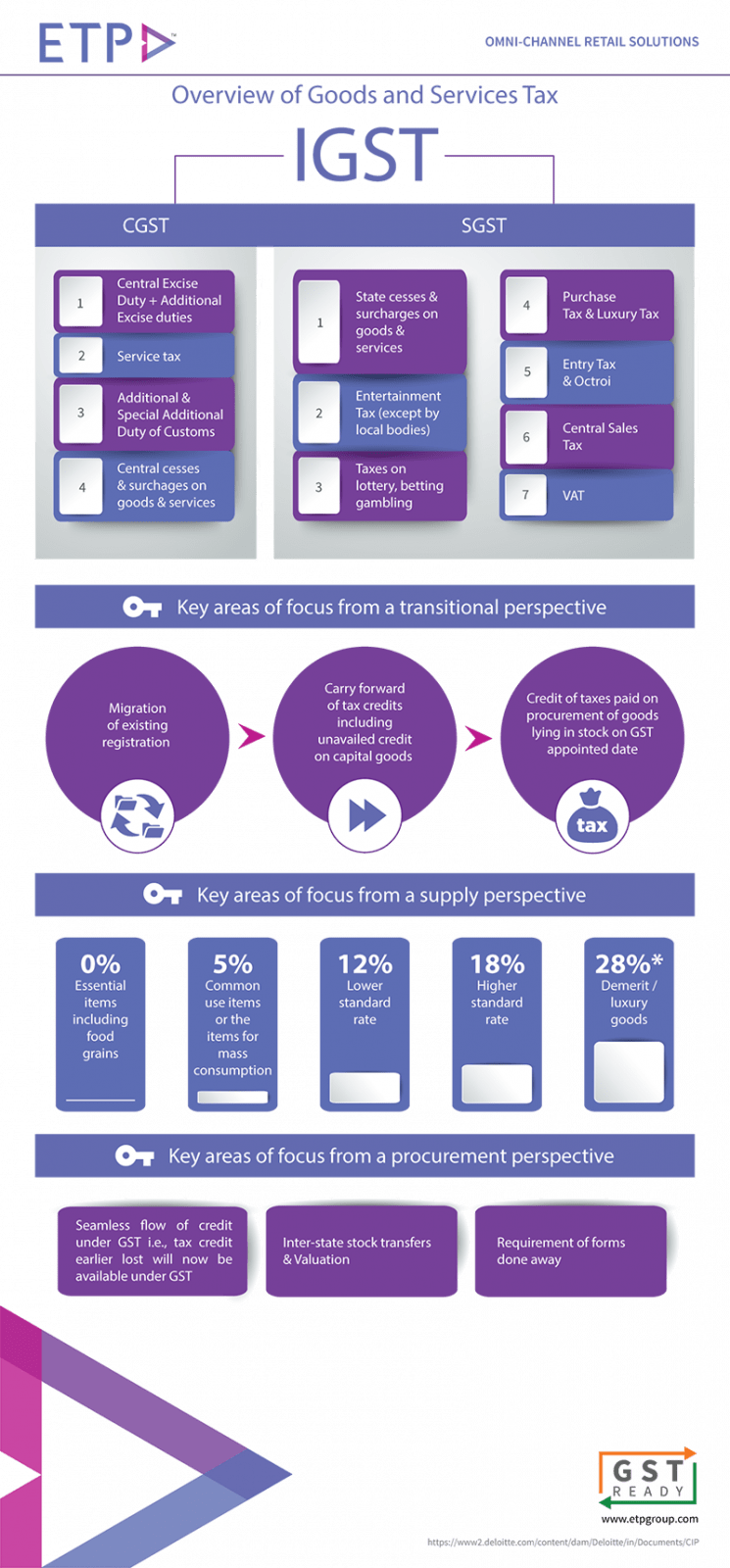

Goods and Service Tax is an indirect tax imposed in India on the supply of goods and services. GST subsumes Service Tax Law, Central Excise Law, VAT, entry tax and Octroi.

The Bad

GST was supposed to impact the unorganized sector. However three years after the launch of GST there is no study to show the impact of GST on the unorganized sector

- Lack of Central Registration. Earlier service providers could register their business in all the states centrally. However, this is no longer possible as service providers now have to pay CGST. So they have to register separately

- Taxation of Free Services. Now even if a company is providing its service for free they will be taxed. Under the earlier tax system, if your service was not for consideration then you wouldn’t be taxed

The Good

GST has removed the cascading effect on the sale of goods and services. This has reduced the price of goods since GST has removed tax on tax. GST is also simpler to file as it is just a form online.

GST increases efficiency in logistics as there is lesser compliance.

Now that multiple taxations is abolished the cost of inputs will go down. Paying VAT and excise duty will no longer be an issue.

Small to Medium scale enterprises whose contribution eluded most have now come under the scanner and their contribution to the economy is accounted for

Our Verdict

While GST is far from the perfect type of Indirect tax, it has encouraged the production of goods and services. Hence on a macro level, the tax has done more good for the economy as a whole than bad.

GST also attempts to bring a transparent and administration free tax system that is consumer and business-friendly. This will make the Indian market more stable and empower Indian companies to compete with foreign companies.