Singles’ Day (11.11) 2018 which will be celebrated on 11 November, will mark the shopping event’s 10th anniversary. It would not be an exaggeration to state that 11.11 has grown much bigger than a commercial fair as is now one of the major annual milestones in China’s cultural calendar, thanks to Alibaba. This year, the company and its partners are gearing up to make this event a phenomenal shopping extravaganza, with sights set on trumping last year’s figures, there is definitely something exciting to look forward to for the shoppers.

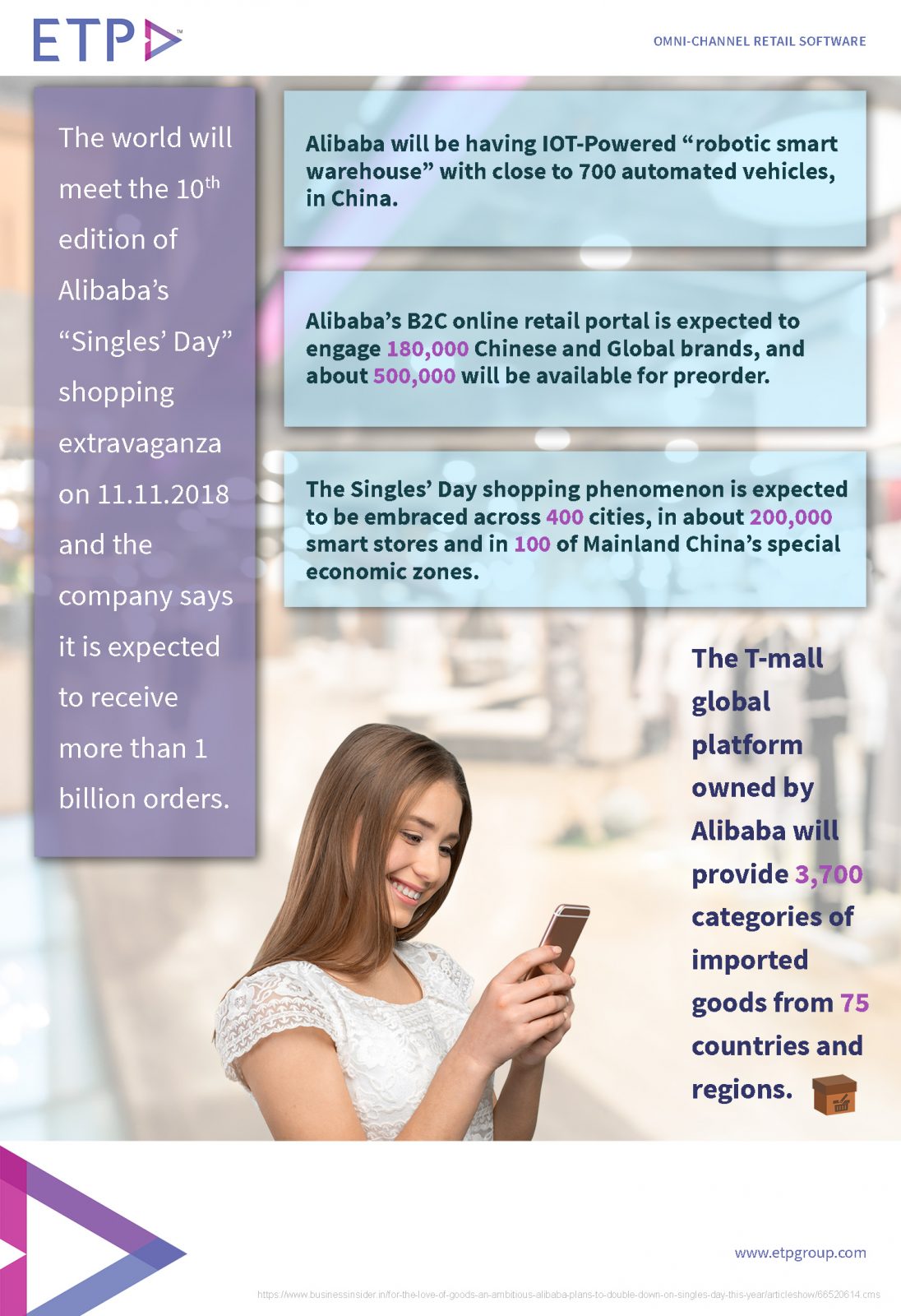

During last year’s event, 812 million parcels were delivered and this year the stakes have been raised higher as the prediction for the milestone in 2018 is more than 1 billion parcels. This could pose some serious challenges in terms of logistics and delivery. One of the ways the company is planning to counter those and preparing for the rush is by opening what is said to be the biggest robotic warehouse in China. This new warehouse positioned as an internet of things-powered, “robotic smart warehouse” will have close to 700 automated vehicles.

Another important move to tackle the delivery challenges while trying to cope up with changing demands and offering a better experience is ensuring quick delivery. Hence this year, for the first time, goods ordered during the Singles Day event will be delivered directly from the stores to the customers and in some-cases within minutes. Short-distance delivery services will also be available in more than 280 cities in the country.

This year the event will also be expanding beyond China through Lazada, the Southeast Asia online platform owned by Alibaba. This will prove to be a strategic and inspiring move in an effort to magnify the events footprint and globalize it. Moreover, this event will also witness diversification in a bigger way as it will not only be restricted to purchasing products, but also offer purchase of services.

With all this at play, one thing is sure that Alibaba would be looking to offer a brand new seamless shopping experience by heavily relying on technology such as omni-channel, AI, cloud and so on to provide an online and offline, cross-platform supply-chain solution and enabling them to cut inventory costs, while increasing operating efficiency, especially around 11.11, the busiest season of the year.

As Singles’ Day 2018 is poised to eclipse again this year, it is just a matter time when the figures start coming in and provide a clearer picture of how much more extravagant and successful this year’s event will be.